The future of 5G and mining

Friday, 17 December, 2021

A white paper analysis, conducted by 5G Americas, on the technical and market requirements of the mining industry, relevant to 5G.

5G technology is an anticipated game changer in mobile networking, promising exponentially faster download speeds and data sharing in real time.

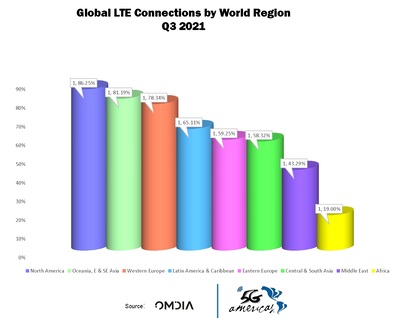

The last generation of wireless cellular, 4G LTE, enabled connectivity of billions of smartphones with data service capabilities that have ushered in a new era of mobile applications, changing the way billions of people live around the globe. Now, 5G is promising to use the same LTE packetisation technology with significant improvements in the radio and packet core to connect things beyond phones.

Current 5G thinking is focused on details of technology such as ultra-low latency wireless connectivity or slicing of provider networks. While these details are interesting there are even larger effects looming on the horizon.

Another foundational enhancement in parallel with 5G lies in the application layers, made possible due to the availability of greater processing power more widely available through cloud hosting. This increased computational capability enables the application of intelligence to compute at nearly real time for many user interactions, such as: analytics, artificial intelligence and augmented reality.

Over the next several years, these transformational waves of high-powered computation are expected to change the way cellular networks are designed and cellular services are consumed. New business to business (B2B) relationships are expected to create novel opportunities and new types of service providers will likely emerge. New consumer form factors that enable new unimagined types of interactions will come to the market, such as wearables that take User Interface (UI) from primarily text/voice/video to new levels — much like what happened with 4G LTE and smartphones.

As enterprises consider their digitisation plans, they are keen to understand alternative and complementary wireless options. This is where discussions on private cellular networks start with enterprise verticals. Private cellular networks operating on 4G LTE have been in existence for many years, but mostly in limited venues where Wi-Fi is not a suitable option or where public cellular is not offered at the right price and required SLA in the right vertical — such as in mining. However, the introduction of 5G has been creating a renewed interest in private cellular in recent years, due to its ability to improve wireless connectivity everywhere, both indoors and outdoors.

With that in mind, let’s take a closer look at what enterprises are looking for in a 5G private cellular solution.

Radio frequency spectrum

The first topic in virtually all wireless discussions in an enterprise involves the choice of radio frequency (RF) spectrum, specifically in terms of its characteristics for providing coverage and throughput at acceptable cost.

Sources of spectrum include:

Unlicensed spectrum

Powers Wi-Fi networks: free and highly suitable for indoors and many outdoors venues, remains the primary choice for wireless among almost all enterprises. Enhancements introduced through IEEE 802.11ax (Wi-Fi 6) as well as expansion of the RF range through introduction of 6E aims to solve many existing problems with Wi-Fi, including congestion and interference. Wi-Fi range of coverage is limited due to its lower power requirements, and as such, it is considered not useful in vast areas where many access points will be needed to cover the same area that a macro cell can cover.

Shared spectrum

A new category of spectrum that is issued by the regulators in which there is an existing incumbent who takes priority for usage of spectrum. These bands can provide more expansive coverage for outdoor use cases at a lower cost than licensed spectrum. However, there is additional complexity of potential interference with incumbent users which needs to be managed by a spectrum management system.

Licensed spectrum

Owned and managed by cellular providers, it presents a rich and versatile set of spectral bands that can offer high throughput and expansive coverage for a fee.

Any combination of the above can be used to support complex use cases for an enterprise.

Availability of suitable RF spectrum enables or limits any wireless deployment and more spectrum is needed as wireless use cases grow in scale and complexity. Additionally, there are a few points about spectrum that do come up in discussion with enterprises, which include:

- higher frequency bands, eg, mmWave, that offer higher throughput at shorter distances and are sensitive to environmental factors, such as metal fuselage or caging. mmWave use cases can be similar to Wi-Fi 6 in terms of coverage and performance, but mmWave uses licensed spectrum versus unlicensed spectrum used in Wi-Fi 6;

- lower frequency bands offer larger area coverage and lower throughput, but they are also capable of penetrating through RF challenged environments;

- mid band frequencies are very versatile as they can provide a good amount of throughput, a decent latency and resilience to environmental factors;

- most immediate outdoors use cases that can benefit from 5G involve mid band and lower band spectrum.

In all spectrum-related discussions, cost of ownership and operation is top of mind. Enterprise IT teams will often consider the most readily available solutions at lower costs before moving on to more complex and costly solutions. For all cases, switching from one wireless mode to another requires significant cost analysis to demonstrate improved bottom lines.

Mining example

Companies looking at deploying private cellular and private 5G networks, focus on the challenges outlined above. Mining has been using 4G LTE technology for several years, there are many lessons to be learned from past experiences of these deployments.

The mining vertical is one of the early adopters of private 4G LTE. Communication in remote mining venues, need for automation and worker safety in isolated and dangerous terrain, as well as lack of reliable carrier-based cellular coverage has promoted mine operators to build and operate their own 4G LTE networks.

Going forward, modernisation and digitisation of the mining vertical is putting additional demands on these early 4G LTE networks and promoting them to expand and evolve to accommodate additional functionality. For any mine operator primary goals of deploying a communication solution can be summarised in the following:

- prevent failures/breakdowns/unplanned downtime

- enhance worker safety

- improve efficiency

- reduce energy consumption

- meet environmental requirements.

Mining sites are usually located in isolated geographic areas where spectrum coverage by cellular providers is limited or non-existent. Sites can include massive areas of undulating terrain that may be constantly changing due to excavation and rock removal activities. Venues can be over ground or underground. Underground mine shafts can be extensive and deep with unusual environmental characteristics that may cause wireless spectrum to behave differently.

Communication services using Wi-Fi mesh or 4G LTE platforms have been in use in mining sites for many years. These are usually simple standalone platforms that enable basic services for connectivity, worker safety, automation of haulage or drilling equipment, and monitoring of site and activities for security purposes.

Demand for more and better wireless has increased by orders of magnitude with the evolution of the mining industry. Specific use cases can include:

- innovative worker wearables and tools, beyond existing push-to-talk (PTT), to enable more intelligent monitoring and hands-free richer interactions of workers remotely. Wearables may be sensors located on hard hats, body cams and remote expert goggles. These devices need to be ruggedised and functional in hard-to-reach places such as mine shafts;

- extensive use of environmental sensors to ensure early detection of dangerous chemicals for both safety reasons as well as conformance to emerging environmental protection requirements;

- fleet management solutions for task scheduling and routing of haulage vehicles;

- automated haulage solutions and automated drilling solutions;

- massive live video and light detection and ranging surveillance via either static or using drones, combined with other venue surveillance for security and safety purposes is top of mind in mining, as well;

- general connectivity in changing terrains: eg, mine shafts, mine pits, wireless set-ups need to be able to change and adapt to these topographical changes.

In addition to the benefits, there are also certain considerations regarding the use of 5G networks in mines, which can include:

- spectrum sources for mines have been either private or leased carrier spectrum. Any outage at the mine can result in massive revenue loss or decreased worker safety. As such mine operators prefer to have full control of their spectrum and radio sources to prevent outage;

- other spectral considerations can relate to how spectrum behaves in different mine locations, such as a mine shaft where higher frequency spectrum does not propagate very well due to weaker reflection capability. For all use cases, a complete RF analysis of mine site and venues is necessary to assess effective spectrum performance and outcomes and ongoing RF analysis and expertise may need to be applied due to the changing terrain of a mine site;

- mining venues will tend to cost optimise for all needs, as with other legacy venues such as oil and gas. Any 5G equipment and solution will have to prove its value for enabling overall cost saving. Existing Wi-Fi mesh and 4G LTE solutions are just being deployed and put to trial. It is not clear how much cost saving 5G will bring;

- the choice of a privately operated network versus a managed service through a carrier operated network is a question, as with other verticals. So far, large complex mining operators have chosen expert IT and network operations firms who are very familiar with nuances of the mining vertical to set up and operate private networks for the mines while smaller and simpler mining sites have used carrier services;

- lack of approved hardened 5G hardware for mining venues. 5G adapters or industrial routers with 5G adapters will need to be ruggedised and integrated into AHS and ADS, and these systems will then need to be tested for performance and reliability in specific mine venues.

Summary of findings and recommendations

Perhaps the most important conclusion that can be drawn from considerations of 5G and 4G LTE in private cellular contexts is that there remains a great deal of innovation to be considered and expected as 5G rolls out and becomes more effectively available. 4G enabled a set of capabilities that were not imaginable earlier, 5G too will be enabling a set of capabilities that may not be imaginable today but are coming.

These early discussions with enterprises are helping pave the way for understanding potential requirements; however, one should not look at these discussions as a final state. All venues and use cases are evolving in several directions, with many possible combinations.

As we gaze at the horizon of possibilities, we should all agree to stay open to change and embrace new solutions. Directions that are becoming clear include: virtualisation and disaggregation of all network components, including the radio networks, movement of application to clouds of all shapes and forms (private, public, hybrid), emergence of new modes of human interaction a la wearables and applications such as AR/VR, automation at a scale that was not possible before, more machine intelligence at venues that we may not have ever considered, flexible hybrid service offers provided in part by a private network and parts by a public provider, and other unforeseen application combinations.

The possibilities are endless. The only firm, unchanging set of requirements are for a solid foundation of security and data sovereignty, as well as an acceptable cost-to-benefit ratio for all. The 5G wireless ecosystem continues to progress as this next generation of innovation continues to address new use cases, applications and vertical markets.

NZ Defence Force deploys high-capacity radios for voice communications

New Zealand Defence Force recently upgraded its voice communication links from analog to digital...

SAPOL engages RFI for in-vehicle repeater upgrade

An SA Police in-vehicle repeater upgrade aims to enhance officer safety and communications.

Customised rugged tech shaping the next era of defence comms

Rugged computing platforms are becoming central to how armed forces protect communication...